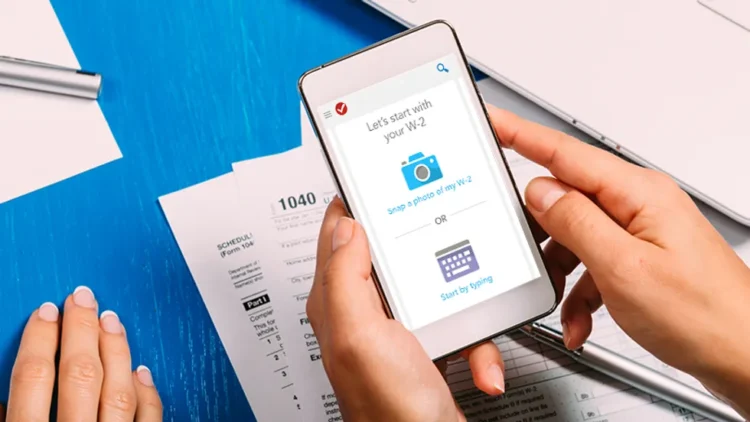

Welcome to this guide on how to import your W2 into TurboTax! As tax season approaches, it’s important to have all of your documents in order. One of the most crucial documents you’ll need is your W2 form, which contains information about your earnings and taxes withheld throughout the year. Fortunately, importing your W2 into TurboTax can save you time and effort when filing your taxes. In this article, we’ll walk you through the steps to import your W2 and provide solutions for common issues that may arise during the process. So, let’s get started!

How to Import Your W2 Into TurboTax

Importing your W2 into TurboTax is a quick and easy process that can save you time and effort when filing your taxes. To get started, make sure you have all of your W2 information ready, including the employer’s name and EIN, as well as your own personal information such as your Social Security number.

Once you have gathered all of the necessary information, log in to your TurboTax account and select the option to import your W2. You will be prompted to enter the employer’s name and EIN, which can be found on your W2 form. After entering this information, TurboTax will automatically import all of the relevant data from your W2 form into your tax return.

It is important to review the imported information carefully to ensure that everything is accurate and up-to-date. If any discrepancies are found, you may need to manually enter or adjust certain details. Overall, importing your W2 into TurboTax can save you time and help ensure that your tax return is completed accurately and efficiently.

What to Do If You Cannot Find Your W2

If you cannot find your W2, don’t panic. There are a few steps you can take to retrieve it. First, contact your employer and request a copy of your W2. They are required by law to provide it to you. If you have changed jobs during the year, make sure to reach out to all of your previous employers.

If you still cannot obtain a copy of your W2, you can request a transcript from the IRS. This will provide you with all the information on your tax return, including your W2 information. You can request this online or by mail.

It’s important to note that if you do not receive your W2 by January 31st, contact the IRS for assistance. Filing without a W2 may result in errors on your tax return and could delay any potential refund.

What to Do If You Receive an Error Message

If you receive an error message while trying to import your W2 into TurboTax, don’t panic. There are a few common reasons why this might happen, and most of them can be easily resolved.

First, make sure that you have entered all of the information from your W2 correctly. Check that your employer’s name and EIN match what is on the form, and that you have entered all of the numbers accurately. Even a small typo can cause an error message.

If you are still receiving an error message after double-checking your information, try importing your W2 again later. Sometimes there can be temporary glitches in the system that prevent successful imports.

If none of these solutions work, don’t hesitate to reach out to TurboTax customer support for assistance. They will be able to help you troubleshoot the issue and get your W2 imported successfully so that you can file your taxes with ease.

Conclusion

In conclusion, importing your W2 into TurboTax is a quick and easy process that can save you time and effort when filing your taxes. By following the steps outlined in this guide, you can ensure that your information is accurate and up-to-date, and avoid any potential errors or delays. If you encounter any issues along the way, don’t hesitate to reach out to TurboTax support for assistance. With their help, you can file your taxes with confidence and peace of mind, knowing that you’ve taken all the necessary steps to ensure a smooth and successful tax season.