Tax lien investing is a lesser-known but lucrative investment strategy that offers substantial returns to savvy investors. It involves purchasing delinquent property tax liens from local governments, thereby enabling investors to earn interest and potentially acquire properties at a fraction of their market value. This article delves into the intricacies of tax lien investing, exploring its benefits, risks, and strategies for success.

Understanding Tax Liens:

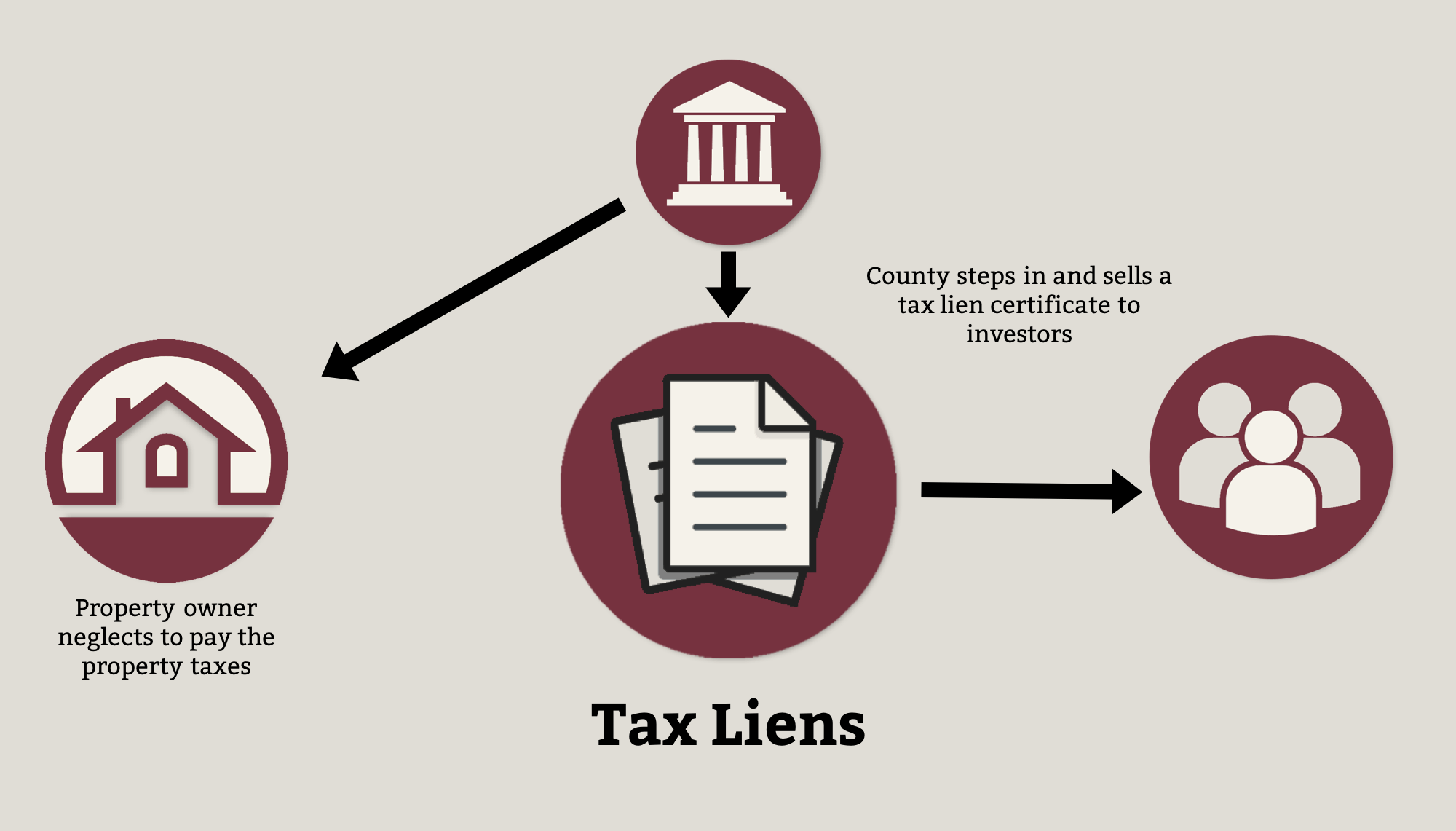

Before diving into tax lien investing, it’s crucial to grasp the concept of tax liens. When property owners fail to pay their property taxes, governments place liens on the properties. These liens serve as a legal claim against the property and its title until the taxes are paid in full. To recoup the unpaid taxes, governments often sell these tax liens to investors through auctions.

Benefits of Tax Lien Investing:

- High Returns: Tax liens typically offer high returns compared to other investment vehicles. Interest rates can range from 8% to 36% annually, providing investors with a potentially significant passive income stream.

- Secured Investment: Tax liens are secured by real estate, making them relatively low-risk compared to other investments. In the event of default, investors have the opportunity to foreclose on the property and recoup their investment.

- Asset Diversification: Tax lien investing allows investors to diversify their portfolios by adding real estate assets without the hassles of property management.

- Government Backing: Since tax liens are issued by local governments, investors benefit from the credibility and stability associated with government-backed investments.

Risks Associated with Tax Lien Investing: While tax lien investing offers attractive returns, it’s not without risks. Some of the potential risks include:

- Property Condition: Investors may encounter properties with liens that exceed their market value or require significant repairs, diminishing the investment’s profitability.

- Redemption Risk: Property owners have the right to redeem the tax lien by paying the outstanding taxes plus interest. If the owner redeems the lien, investors may receive only the principal amount invested, missing out on potential interest earnings.

- Legal Complexities: Tax lien investing involves navigating complex legal procedures, including foreclosure laws and redemption periods, which vary by jurisdiction. Lack of expertise or legal guidance can expose investors to legal pitfalls.

- Competitive Auctions: In areas with high demand for tax liens, auctions can become highly competitive, driving down potential returns or leading to the acquisition of undesirable liens.

Strategies for Success in Tax Lien Investing:

- Research and Due Diligence: Before participating in tax lien auctions, thorough research is essential. This includes assessing the market, understanding local tax laws, and evaluating the properties available for auction.

- Diversification: Spread investments across multiple tax liens to mitigate risks. Diversification can help balance the impact of potential defaults or redemption.

- Focus on Quality Over Quantity: Rather than solely focusing on high-interest rates, prioritize liens on properties with solid potential for redemption or foreclosure.

- Understand Redemption Periods: Familiarize yourself with redemption periods in your target market. Investing in jurisdictions with shorter redemption periods can expedite returns and reduce exposure to redemption risk.

- Stay Informed: Stay updated on changes in tax laws, auction schedules, and market conditions. Joining local investor groups or seeking advice from experienced investors can provide valuable insights.

Conclusion:

Tax lien investing presents a unique opportunity for investors to generate passive income and acquire real estate assets at discounted prices. While it offers attractive returns, it’s crucial for investors to conduct thorough research, understand the associated risks, and implement sound strategies for success. With careful planning and diligence, tax lien investing can be a rewarding addition to an investor’s portfolio, offering both financial gain and asset diversification.