In today’s fast-paced world, businesses need a reliable and efficient payment and banking system to stay competitive. moniepoint app is an all-in-one payment and banking app that provides businesses with a seamless and secure platform to manage their financial transactions. With over 20 million Nigerians transacting using Moniepoint monthly [1], it’s clear that this app is making waves in the Nigerian business world.

What is Moniepoint?

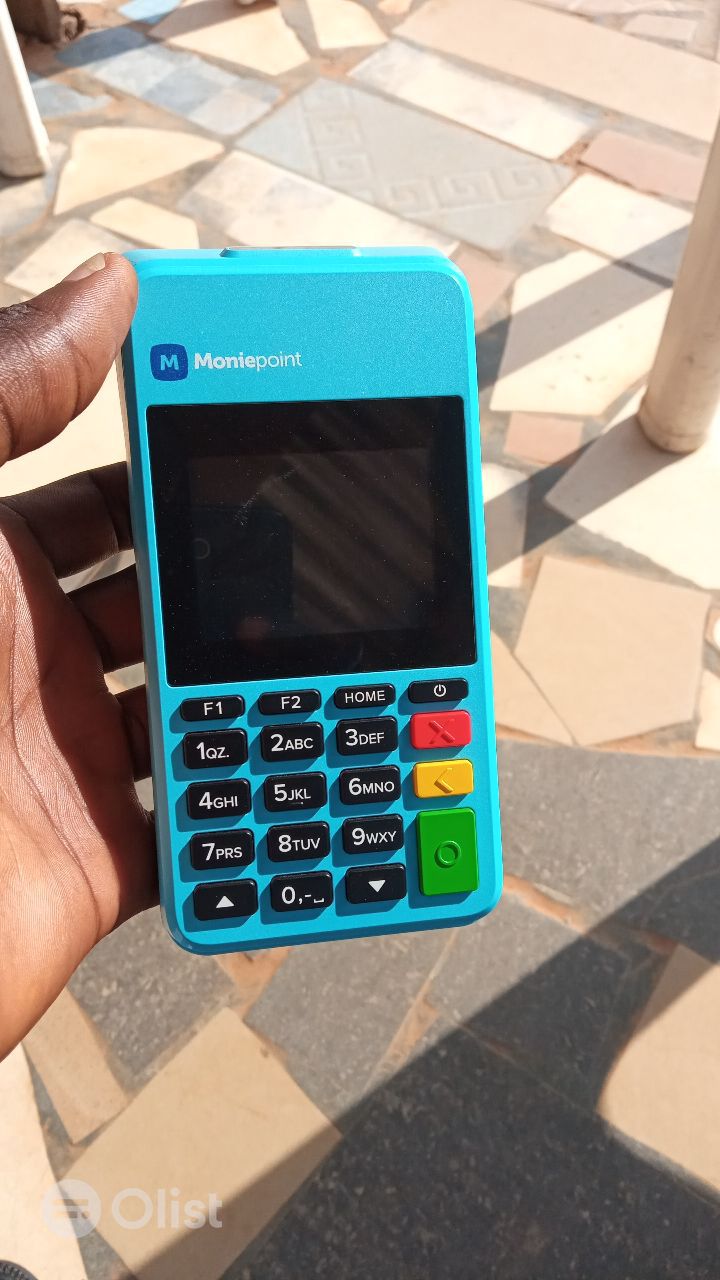

Moniepoint is a payment and banking app designed to provide businesses with a simple and secure platform to manage their financial transactions. The app offers a range of features, including sending and receiving money, paying bills, and accessing banking services. Moniepoint provides an all-in-one payments, banking, and operations platform for businesses [2].

Features of Moniepoint

1. Banking Services: Moniepoint offers banking services such as opening a bank account, depositing and withdrawing money, and accessing loans. The app is designed to make banking easier for businesses by providing a simple and secure platform to manage their finances.

2. Payments: With Moniepoint, businesses can send and receive money from anywhere in Nigeria. The app supports multiple payment options, including bank transfers, card payments, and USSD payments. This makes it easier for businesses to receive payments from customers and pay suppliers.

3. Bills Payment: Moniepoint also allows businesses to pay bills such as electricity bills, cable TV subscriptions, and airtime top-ups. This feature saves businesses time and effort by eliminating the need to visit multiple payment platforms.

4. Business Account: Moniepoint offers businesses the option to open a free business account in minutes. This account provides businesses with access to all their banking needs in one app. Businesses can send money, receive payments, pay bills, and much more on the Moniepoint app [3].

How Moniepoint Works

To use Moniepoint, businesses need to download the app from the Google Play Store or the App Store. Once downloaded, businesses can sign up for a free account in their business name. The app requires basic information such as business name, email address, and phone number. Once the account is set up, businesses can start using the app to manage their financial transactions.

Benefits of Using Moniepoint

1. Convenience: Moniepoint provides businesses with a convenient platform to manage their financial transactions. The app eliminates the need to visit multiple payment platforms, saving businesses time and effort.

2. Security: Moniepoint is designed to provide businesses with a secure platform to manage their financial transactions. The app uses advanced security features such as two-factor authentication and encryption to protect businesses’ financial information.

3. Efficiency: Moniepoint is designed to make financial transactions more efficient for businesses. The app offers a range of features that make it easier for businesses to manage their finances, including sending and receiving money, paying bills, and accessing banking services.

4. Cost-effective: Moniepoint is a cost-effective solution for businesses looking to manage their financial transactions. The app offers competitive rates for banking services and payment transactions.

Conclusion

Moniepoint is an all-in-one payment and banking app that provides businesses with a simple and secure platform to manage their financial transactions. The app offers a range of features, including banking services, payments, bills payment, and business accounts. With over 20 million Nigerians transacting using Moniepoint monthly [1], it’s clear that this app is making waves in the Nigerian business world. Businesses looking for a convenient, secure, and cost-effective solution to manage their financial transactions should consider using Moniepoint.