In the dynamic world of finance and investment, individuals seek tools that empower them with insights and strategies to make informed decisions. GuruFocus emerges as a prominent player in this realm, offering a comprehensive platform that caters to investors’ needs. In this article, we delve into the various facets of GuruFocus, exploring its features, functionalities, and the value it brings to the investment landscape.

1. Understanding GuruFocus:

GuruFocus is an investment research platform designed to provide investors with a wealth of information and analytical tools. Founded in 2004 by Charlie Tian, the platform has evolved over the years to become a go-to resource for both novice and seasoned investors.

2. Key Features:

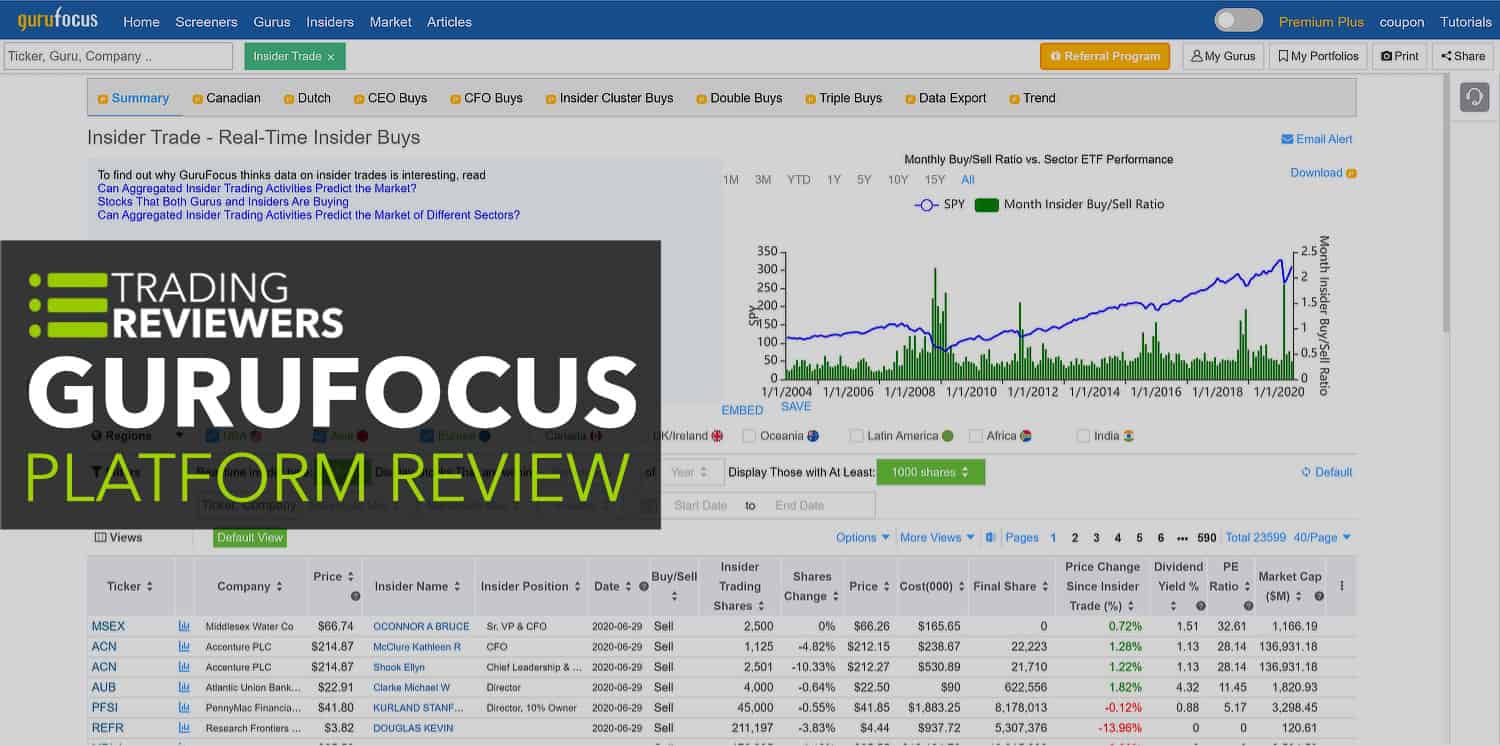

- Guru Trades: One of GuruFocus’s standout features is its tracking of guru trades. The platform monitors the buying and selling activities of renowned investors, often referred to as “gurus,” and provides real-time updates on their portfolio changes. This feature allows users to gain insights into the investment decisions of successful market players.

- GuruFocus Score: The GuruFocus Score is a proprietary metric that assesses a company’s financial strength and profitability. It condenses complex financial data into a single score, aiding investors in evaluating the overall health of a potential investment.

- Interactive Charts and Tools: GuruFocus offers a suite of interactive charts and tools that empower users to perform in-depth technical analysis. From historical stock prices to customizable charts, these tools assist investors in making data-driven decisions.

- Value Screeners: GuruFocus provides various value screeners based on the principles of renowned value investors such as Warren Buffett, Peter Lynch, and Benjamin Graham. These screeners help users identify stocks that align with specific investment philosophies.

- Stock Research: Users can access comprehensive stock research reports on GuruFocus, covering essential financial metrics, valuation ratios, and growth prospects. This aids in thorough due diligence before making investment decisions.

3. GuruFocus in Action:

- Tracking Guru Portfolios: Investors can follow the portfolios of their favorite gurus, gaining valuable insights into the stocks that these successful investors are bullish on. This feature is particularly useful for those looking to align their investment strategies with proven market leaders.

- Portfolio Management: GuruFocus enables users to build and manage their portfolios seamlessly. The platform provides a consolidated view of portfolio performance, allocation, and individual stock analysis, streamlining the decision-making process for investors.

- Alerts and Notifications: Staying updated on market developments is crucial for investors. GuruFocus offers customizable alerts and notifications, ensuring that users are informed about changes in their watchlist or guru portfolios in real-time.

4. Investment Research and Education:

GuruFocus goes beyond being a mere data provider; it serves as an educational hub for investors. The platform offers a plethora of articles, videos, and tutorials that cover various aspects of investing, from fundamental analysis to market trends. This commitment to education sets GuruFocus apart, making it a valuable resource for those looking to enhance their investment knowledge.

5. Pros and Cons:

-

Pros:

- Comprehensive Data: GuruFocus provides a vast array of financial data, ensuring that investors have access to the information they need for thorough analysis.

- Guru Insights: Tracking the moves of successful investors can be a guiding light for users, helping them make more informed investment decisions.

- User-Friendly Interface: The platform is designed with user convenience in mind, offering an intuitive interface that caters to both beginners and experienced investors.

- Educational Resources: The educational content on GuruFocus adds significant value, making it more than just a data platform.

-

Cons:

- Subscription Costs: While GuruFocus offers a free version with limited features, the more advanced functionalities come with subscription costs. This could be a deterrent for some investors, especially those who are just starting.

- Learning Curve: The multitude of features might be overwhelming for new users, requiring some time to become familiar with the platform’s full potential.

6. Conclusion:

In a landscape where information is key, GuruFocus stands out as a powerful ally for investors. Its comprehensive set of features, coupled with the ability to track the moves of successful investors, makes it a valuable tool in the arsenal of those navigating the complex world of finance.

While the platform may not be suitable for everyone, especially those averse to subscription costs, its educational resources and commitment to empowering users with data and insights position GuruFocus as a platform that goes beyond traditional financial research tools.

As technology continues to reshape the investment landscape, GuruFocus remains at the forefront, adapting and evolving to meet the changing needs of investors. Whether you are a seasoned investor or someone just starting on their investment journey, exploring what GuruFocus has to offer could be a worthwhile endeavor in enhancing your financial acumen.